How much money would developer Forest City Ratner put up to build Atlantic Yards? We don't know, but there are hints, not previously reported, that suggest that a good portion of the developer's investment might be covered by its developer fee alone.

The 7/1/07 New York Times article on Atlantic Yards financials reported:

Forest City itself would earn a development fee of 5 percent of the project’s total cost: roughly $200 million if the entire project is built as planned. Most of that, company executives said, would go toward recovering the company’s internal costs. They also said that Forest City owns a significant share of the project, in addition to being the developer.

That leaves a lot of slack, since "much" of that $200 million could still go to recoup any investment and, once that's recouped, the "significant share" could generate gravy.

Private equity

FCR's contribution would come under the category of "private equity," which would account for $926.2 million out of the $4 billion project cost, according to this memo prepared by the Empire State Development Corporation.

This was released to the Public Authorities Control Board (PACB), but not to the public. It came to light as part of the lawsuit challenging the Atlantic Yards environmental review.

Looking at the MTA bid

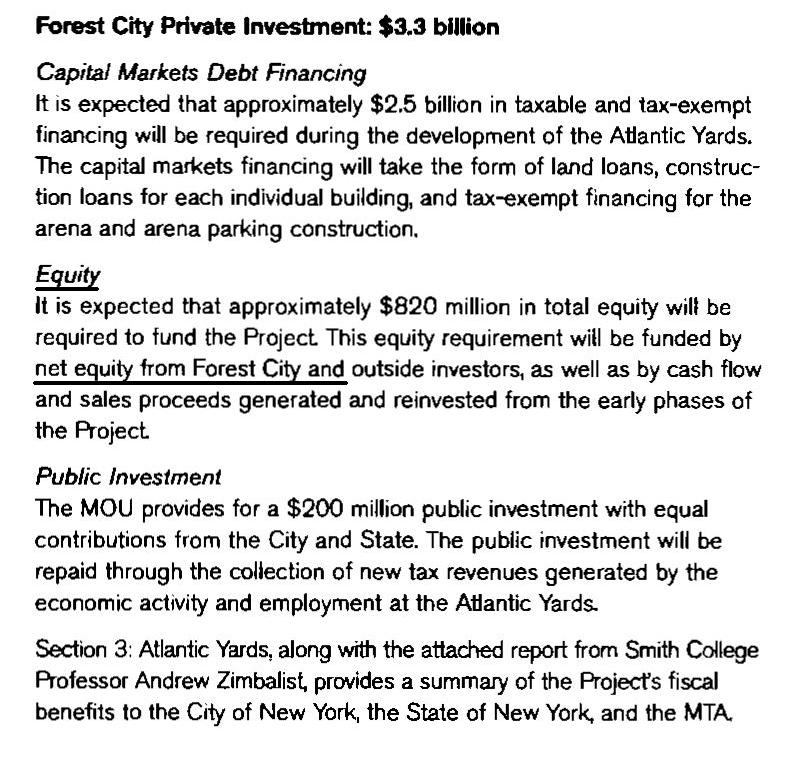

How much of that private equity would come from FCR? We get some clues, if not a solid accounting, on p. 45 of this PDF, which was part of the developer's 2005 bid to the Metropolitan Transportation Authority for the Vanderbilt Yard.

How much of that private equity would come from FCR? We get some clues, if not a solid accounting, on p. 45 of this PDF, which was part of the developer's 2005 bid to the Metropolitan Transportation Authority for the Vanderbilt Yard.

(Corrected: I had written that the document was public, but not online until the lawsuit. Actually, it was already online.)

Given that the total project cost was then $3.5 billion, the document points to a about $100 million less than currently announced in private equity:

It is expected that approximately $820 million in total equity will be required to fund the Project. This equity requirement will be funded by net equity from Forest City and outside investors, as well as by cash flow and sales proceeds generated and reinvested from the early phases of the project.

(Emphasis added)

Could be a fraction

So it's quite possible that Forest City will invest only a fraction of the now $926.2 million figure. Add outside investors. Add cash flow from the Barclays sponsorship--say $20 million a year. Add profits from condos. Of course there are many question marks, but it could be a very sweet deal.

So the documents prepared by FCR and by KPMG, which indicate an Internal Rate of Return (IRR) of 7.7% on the arena and 9.6% on the rest of the project, refers just to the return on the various flows of money, not the developer's investment, as the Times failed to explicate.

Forest City Ratner's payday, which would include not just the development fee but a segment of other revenues, could be much, much larger. So it's not implausible that the development fee could, in itself, cover a significant portion of the FCR's investment.

True, developers typically get rewarded for putting together a complicated deal. The question is how much. And Forest City sure hasn't come clean. We don't know how much they're putting in, and it's not clear that any public agencies know either.

The 7/1/07 New York Times article on Atlantic Yards financials reported:

Forest City itself would earn a development fee of 5 percent of the project’s total cost: roughly $200 million if the entire project is built as planned. Most of that, company executives said, would go toward recovering the company’s internal costs. They also said that Forest City owns a significant share of the project, in addition to being the developer.

That leaves a lot of slack, since "much" of that $200 million could still go to recoup any investment and, once that's recouped, the "significant share" could generate gravy.

Private equity

FCR's contribution would come under the category of "private equity," which would account for $926.2 million out of the $4 billion project cost, according to this memo prepared by the Empire State Development Corporation.

This was released to the Public Authorities Control Board (PACB), but not to the public. It came to light as part of the lawsuit challenging the Atlantic Yards environmental review.

Looking at the MTA bid

(Corrected: I had written that the document was public, but not online until the lawsuit. Actually, it was already online.)

Given that the total project cost was then $3.5 billion, the document points to a about $100 million less than currently announced in private equity:

It is expected that approximately $820 million in total equity will be required to fund the Project. This equity requirement will be funded by net equity from Forest City and outside investors, as well as by cash flow and sales proceeds generated and reinvested from the early phases of the project.

(Emphasis added)

Could be a fraction

So it's quite possible that Forest City will invest only a fraction of the now $926.2 million figure. Add outside investors. Add cash flow from the Barclays sponsorship--say $20 million a year. Add profits from condos. Of course there are many question marks, but it could be a very sweet deal.

So the documents prepared by FCR and by KPMG, which indicate an Internal Rate of Return (IRR) of 7.7% on the arena and 9.6% on the rest of the project, refers just to the return on the various flows of money, not the developer's investment, as the Times failed to explicate.

Forest City Ratner's payday, which would include not just the development fee but a segment of other revenues, could be much, much larger. So it's not implausible that the development fee could, in itself, cover a significant portion of the FCR's investment.

True, developers typically get rewarded for putting together a complicated deal. The question is how much. And Forest City sure hasn't come clean. We don't know how much they're putting in, and it's not clear that any public agencies know either.

Comments

Post a Comment